The China in MENA Brief — April 21, 2025

Tehran courts Beijing and Moscow to dilute U.S. leverage—while shifting blame onto Israel

Hope you had a great Easter! Today’s brief:

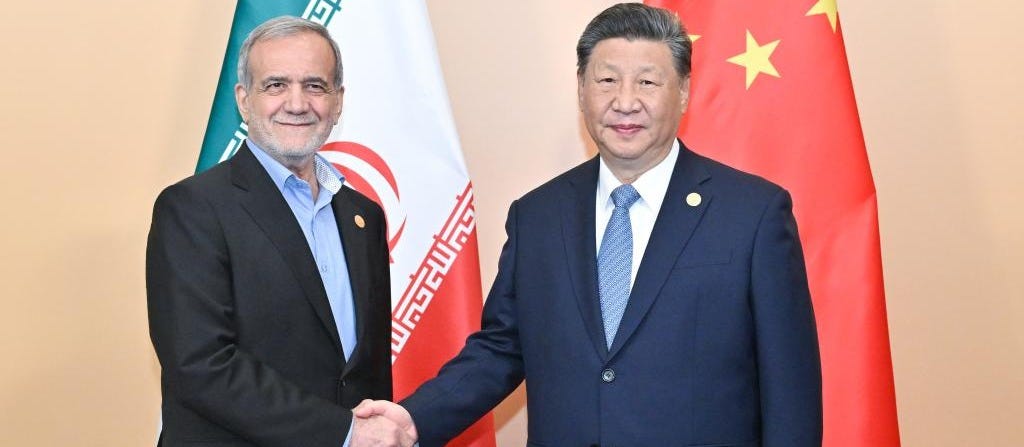

1. Iran Briefs China, Blames Israel for Disrupting U.S. Nuclear Talks

In a calibrated move, Iran will brief China this week ahead of a third round of nuclear discussions with the United States, set to take place in Oman. Iranian Foreign Minister Abbas Araghchi’s visit to Beijing follows similar consultations with Russia last week, underscoring Tehran’s reliance on its strategic backers as it negotiates under pressure.

Tehran has also accused Israel of attempting to “undermine and disrupt” the diplomatic process—a narrative likely intended to preempt blame for any failure in talks and to rally support from Beijing and Moscow. Both China and Russia were original parties to the now-defunct 2015 JCPOA nuclear deal and remain critical voices in any successor arrangement.

Strategic Takeaways:

Axis of Coordination: Iran’s “consultation” strategy with China and Russia reinforces a multipolar negotiating structure that weakens Western leverage and complicates U.S. efforts to isolate Tehran.

Undermining U.S. Narrative Discipline Tehran’s accusation complicates Washington’s messaging. If the diplomatic breakdown is blamed on Israel, the U.S. risks internal and allied discord. China benefits from any wedge between the U.S. and its closest Middle East partner, especially as it expands influence in the Gulf and Levant.

Delay Benefits Beijing

Every delay in resolving the Iran-U.S. nuclear issue buys China more time to:

Secure discounted Iranian oil,

Deepen its economic footprint via the 25-year cooperation deal,

Expand military coordination with Tehran without triggering new Western sanctions.

2. ADNOC Strikes Triple LNG Deal with China, Deepens Energy Convergence

In a weekend flurry of deals, Abu Dhabi National Oil Company (ADNOC) signed three long-term LNG supply contracts with Chinese firms, including China National Offshore Oil Corporation (CNOOC), ENN Natural Gas, and state trader Zhenhua Oil. The agreements mark a significant tightening of China–Gulf energy ties as Beijing races to secure energy diversification amid ongoing U.S. decoupling and maritime chokepoint risks.

These LNG contracts expand on existing crude and petrochemical deals, reinforcing the UAE’s position as a reliable supplier and strategic partner in China’s dual-circulation energy strategy.

Strategic Takeaways:

Gulf Anchor, Pacific Hedge: As China braces for potential Indo-Pacific disruptions, Gulf LNG offers a long-haul hedge—less exposed to U.S. naval chokepoints than South China Sea routes.

Petroyuan Infrastructure: The deals may be settled in renminbi under China’s broader push for petroyuan settlement frameworks, giving Beijing greater insulation from dollar-denominated energy markets.

3. Aramco and China’s BYD Partner on EV Tech as Riyadh Eyes Clean Mobility Edge

Saudi Aramco has signed a joint development agreement with China’s electric vehicle giant BYD to co-develop next-generation new energy vehicle (NEV) technologies. The deal—brokered via Aramco’s tech subsidiary SATC—focuses on improving vehicle efficiency and environmental performance, aligning with the Kingdom’s broader push toward clean transportation under Vision 2030.

This marks Aramco’s first direct move into co-developing EV tech with a foreign automaker and signals a deeper fusion between Gulf petro-states and Chinese industrial innovation.

Strategic Takeaways:

Dual Play: Oil and Electrification: Riyadh isn’t abandoning hydrocarbons—it’s hedging. By investing in EV platforms while dominating upstream oil, Aramco positions itself to profit across the mobility spectrum.

Tech Transfer Without the West: China offers Gulf states a path to cutting-edge industrial development with fewer strings attached—no ESG conditionality, no export controls, and full-spectrum IP cooperation.

BYD as Geopolitical Export: BYD’s expansion into the Gulf makes China’s EV diplomacy tangible. It’s not just about cars—it’s about embedding Chinese standards in future transport ecosystems across Eurasia.

4. U.S. Accuses Chinese Satellite Firm of Enabling Houthi Attacks in the Red Sea

The U.S. State Department has publicly accused Chang Guang Satellite Technology—a Chinese firm linked to the PLA—of supplying targeting imagery to Iran-backed Houthi militants in Yemen. The intelligence, reportedly used to strike U.S. and international vessels in the Red Sea, marks a rare direct attribution of military-grade support from a Chinese company to a designated terrorist proxy.

The accusation, first reported by the Financial Times, underscores rising tensions as Beijing’s so-called “neutrality” in Middle East conflicts is increasingly called into question. Despite prior diplomatic warnings, Washington says the support continues.

Strategic Takeaways:

Gray-Zone Escalation: This is not benign commercial cooperation—Beijing is probing the boundaries of conflict via deniable, tech-enabled support to U.S. adversaries.

Proxy Leverage, Superpower Cover: By arming Houthis with satellite intel, China helps Iran project power while keeping its own fingerprints indirect—forcing the U.S. to navigate multiple levels of deterrence simultaneously.

© 2025 The China in MENA Project. All rights reserved.

Newsletter every Monday & Friday ( X: @chinainmena)

Founder/Manager Zineb Riboua ( X: @zriboua)

Contact: riboua@chinainmena.com

you always writes some of the best articles or newsletters