The China in MENA Brief — April 4, 2025

U.S. Pressure Mounts, China Expands Strategic Ties Across the Global South

1. China’s Non-State Refiners Recoil from Iran Oil Under U.S. Heat

Small Chinese refineries—known as “teapots”—are holding off on new Iranian crude purchases after the U.S. sanctioned Shouguang Luqing Petrochemicals, a non-state processor in Shandong.

Roughly 90% of Iranian oil to China lands in Shandong, where teapots dominate. While Luqing hasn’t been cut off from financing, its fate could shape risk appetite across the sector—especially for refineries reliant on Iranian feedstock.

Despite the freeze in new deals, March imports are still expected to rise month-on-month. Iranian cargoes on non-sanctioned vessels have continued to discharge at Chinese ports, suggesting enforcement gaps persist.

But those gaps may soon close. U.S. sanctions on the Huizhou Huaying terminal and two OFAC-blacklisted tankers that recently discharged in Yangshan and Dongying point to a tightening net.

Strategic Takeaways:

Shadow Trade Strain: The U.S. is moving upstream—hitting infrastructure nodes, not just vessels. This increases compliance risk for terminals, not just traders.

Energy Diplomacy Tightrope: Beijing must weigh its strategic alignment with Tehran against rising operational costs for importers and the potential diplomatic fallout with Washington.

Testing the Periphery: Washington’s signal is clear: even non-state players operating at the edge of formal systems are now fair game. That widens the risk envelope for semi-official trade networks.

2. China and Russia Shield Iran in Nuclear Standoff with the West

In a coordinated diplomatic show, Russian Foreign Minister Sergei Lavrov and his Chinese counterpart Wang Yi reaffirmed their joint stance on Iran’s nuclear program and the Korean Peninsula during high-level meetings in Moscow this week.

According to the Russian foreign ministry, the two sides agreed that nuclear negotiations with Tehran—pressed by the U.S.—should only resume on the basis of “mutual respect” and the full lifting of sanctions. This mirrors a joint statement issued last month, underscoring growing Sino-Russian alignment on key nonproliferation issues.

Wang’s visit, which included a meeting with President Vladimir Putin, is the latest signal of deepening strategic cooperation between Moscow and Beijing, as both powers seek to counterbalance U.S. pressure on multiple fronts.

Strategic Takeaways:

Unified Front: China and Russia are reinforcing a shared diplomatic framework that resists Western-led nuclear negotiations with Iran unless sanctions are lifted.

Parallel Pressure: By invoking the Korean Peninsula and Ukraine alongside Iran, Beijing and Moscow are asserting their role as alternative power brokers in regional security issues.

Axis of Resistance? While not formalized, the messaging suggests a tightening bloc of strategic defiance against U.S.-led diplomacy.

3. China’s Solar Surge Finds New Lifelines in the Global South

China’s solar exports surged into the Global South in 2024, with Saudi Arabia and Pakistan leading a wave of new demand. Over half of all Chinese solar panels went to developing countries, according to Ember’s latest export tracker.

While total exports rose 10%, shipments to the Global South jumped 32%. Exports to the Global North, meanwhile, fell 6%—a sign of shifting geopolitical energy flows and growing green tech competition.

Pakistan and Saudi Arabia saw distinct solar booms, but late 2024 also saw rising deliveries to smaller African and Latin American markets, signaling China’s push to open new frontiers for its solar dominance.

Strategic Signals:

Pivot South: China is turning to emerging markets as traditional buyers cool and trade friction grows.

Soft Power Play: Solar exports are Beijing’s diplomatic toolkit—clean energy with political leverage.

4. ASEAN Eyes New Trade Bloc with China and Gulf Amid U.S. Trade Tensions

Malaysia has invited China and key Arab Gulf states to a joint summit with ASEAN in Kuala Lumpur this May—raising questions about whether a new trade alignment is emerging in response to Donald Trump’s tariffs.

Prime Minister Anwar Ibrahim, whose country chairs the 10-member ASEAN bloc this year, framed the move as an effort to secure the region’s “strategic relevance in a multipolar world.” He denied the summit was aimed at countering the U.S. or choosing sides.

But the optics are hard to ignore. A potential trilateral trade axis—ASEAN, China, and Gulf energy economies—would bind together several countries with large U.S. trade surpluses and shared incentives to de-risk from dollar-centric trade.

Experts warn Washington will be watching closely. “Trump isn’t afraid to use trade policy as a sledgehammer,” said Sam Baron of the Yokosuka Council on Asia-Pacific Studies. “Anwar needs to be cautious.”

What to Watch:

Strategic Realignment: ASEAN may be testing the waters for new trade architecture outside the U.S.-led system.

Energy-Industrial Fusion: A China-Gulf-ASEAN axis would combine capital, industrial capacity, and resource leverage.

5. Chinese Ambassador Pushes Innovation Agenda as “Two Sessions” Open New Horizons for China-Israel Cooperation

What happened?

Beijing’s recently concluded “Two Sessions” spotlighted innovation and human capital as central pillars of China’s development strategy—signals that China’s Ambassador to Israel, Xiao Junzheng, has directly tied to expanding bilateral cooperation.

In an article published in Israel Hayom, Ambassador Xiao Junzheng underscored how the outcomes of the Two Sessions offer "new horizons" for China-Israel cooperation, particularly in technology, healthcare, and education. His remarks reflect a coordinated push from Beijing to align domestic innovation priorities with targeted international partnerships.

General Secretary Xi Jinping, during discussions with Jiangsu Province deputies, called for the integration of education, technology, and professional training to modernize China’s industrial system. He emphasized translating scientific achievements into real productivity—an approach that mirrors the operational model of existing China-Israel platforms such as the Changzhou Innovation Park, Shanghai Innovation Park, and the Guangdong Technion – Israel Institute of Technology.

These joint ventures, grounded in the “education + innovation + professionals” framework, have already yielded cooperation in life sciences, new energy, and intelligent manufacturing—areas where Israel has comparative advantages and strong commercial interest.

A second key policy shift from this year’s sessions was China’s focus on investing in people, with new commitments to channel public and private capital into sectors like education, healthcare, and elderly care services. According to Ambassador Xiao Junzheng, this trend unlocks “broader prospects” for Israeli companies operating in medtech, edtech, and aging-tech, which align with China’s growing domestic demand.

As China seeks to convert innovation into productivity and human development into growth, Ambassador Xiao Junzheng’s messaging signals a deliberate effort to position Israel as a strategic partner in delivering on both fronts.

Background:

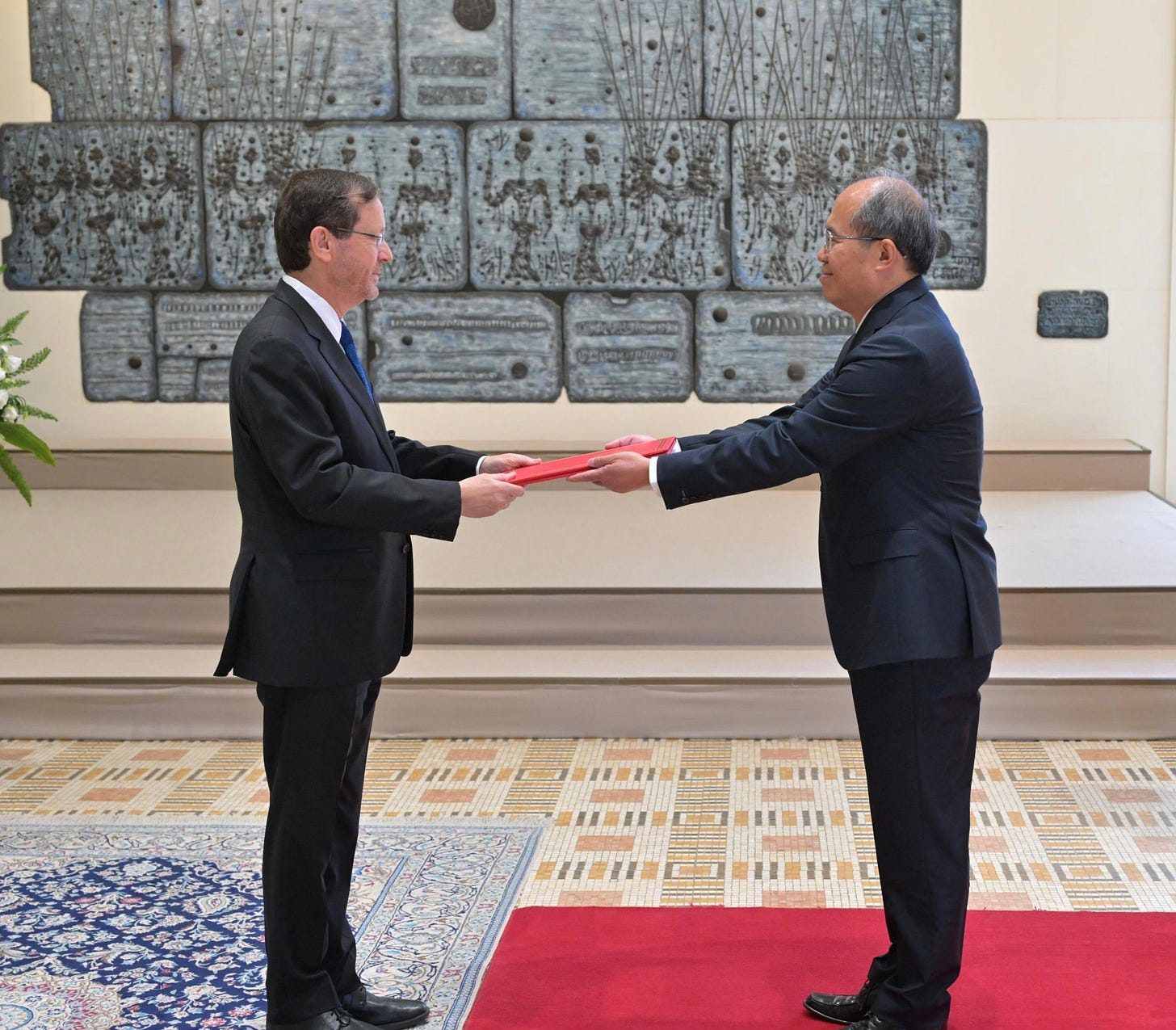

Xiao Junzheng is the current Ambassador Extraordinary and Plenipotentiary of the People's Republic of China to the State of Israel. Born in March 1970, he holds a Ph.D. in history and is a member of the Communist Party of China.

Prior to his appointment in Israel, Xiao Junzheng served as China's ambassador to Greece. His diplomatic career includes extensive experience in the Middle East and North Africa, with postings in Iran, Turkey, and Egypt, as well as roles within the Ministry of Foreign Affairs focusing on the region. In November 2024, Xiao was appointed as China's ambassador to Israel, succeeding Cai Run. He officially assumed the position following his appointment by President Xi Jinping.

© 2025 The China in MENA Project. All rights reserved.

Newsletter every Monday & Friday ( X: @chinainmena)

Founder/Manager Zineb Riboua ( X: @zriboua)

Contact: riboua@chinainmena.com