The China in MENA Brief — March 31, 2025

U.S. Sanctions, EV Expansion, and Libya's Deadlock

1. China-Iran Tech Axis Targeted as U.S. Widens Sanctions Net

In a sweeping escalation of tech restrictions, the U.S. Commerce Department has added 80 new entities to its Entity List, targeting firms from China, the UAE, Iran, South Africa, and Taiwan. The move aims to choke off Beijing’s access to cutting-edge technologies driving its military edge—from quantum computing to hypersonic weapons.

Among the newly listed are:

Chinese firms advancing AI chips, supercomputers, and quantum systems for military use

Entities tied to Iran’s UAV and missile programs, with the main goal of disrupting Iran’s procurement of unmanned aerial vehicles (UAVs) and related defense items

UAE and South African actors linked to the training of Chinese military pilots using NATO-based systems

The message from Washington: advanced U.S. tech will no longer be allowed to flow—directly or indirectly—into China’s military-industrial machine.

“American technology should never be used against the American people. BIS is sending a clear, resounding message that the Trump administration will work tirelessly to safeguard our national security by preventing U.S. technologies and goods from being misused for high performance computing, hypersonic missiles, military aircraft training, and UAVs that threaten our national security,” said Under Secretary of Commerce for Industry and Security Jeffrey I. Kessler.

This isn’t just about semiconductors—it’s about the emerging battlefield of influence in the Global South. The U.S. is signaling that deepening security or tech ties with Beijing comes at a cost, even for countries that see themselves as neutral or non-aligned.

What This Signals About Iran-China Relations:

Beyond Diplomacy: The U.S. now sees the Iran-China relationship as a growing military-technical alliance, not merely a diplomatic or economic partnership.

Cutting the Supply Chain: Sanctions on Iran-linked entities aim to disrupt Beijing’s indirect support for Tehran’s drone and missile development.

Calculated Alignment: China’s deepening ties with Iran reflect a strategic choice to engage sanctioned states when it serves its global positioning.

Regional Rebalancing: As U.S. and European influence contracts in parts of the Middle East, China is filling the vacuum through industrial and defense partnerships.

Reframing Iran: In Washington’s eyes, Iran is no longer a standalone rogue actor — it is increasingly treated as an integrated player in China’s expanding global defense network.

2. China’s EV Strategy Finds a Hub in Egypt

China’s electric vehicle ambitions are no longer confined to its domestic market — they’re global, and Egypt is quickly becoming a central node in that expansion strategy.

In a recent interview with Xinhua, Khaled Geyushi, vice chairman of Geyushi Automotive, outlined how Chinese EV makers are fueling industrial growth in Egypt. His company sources powertrains from China’s FAW and assembles buses locally — 80% of which are exported to Saudi Arabia and Jordan. But this model isn’t just about regional exports; it’s about strategic positioning.

By partnering with Egyptian firms, Chinese automakers gain access not only to local assembly capacity but also to a wider trade corridor spanning over a billion consumers across Africa, the Arab world, and Europe — thanks to Egypt’s extensive trade agreements and its geographic position as a logistical bridge between continents.

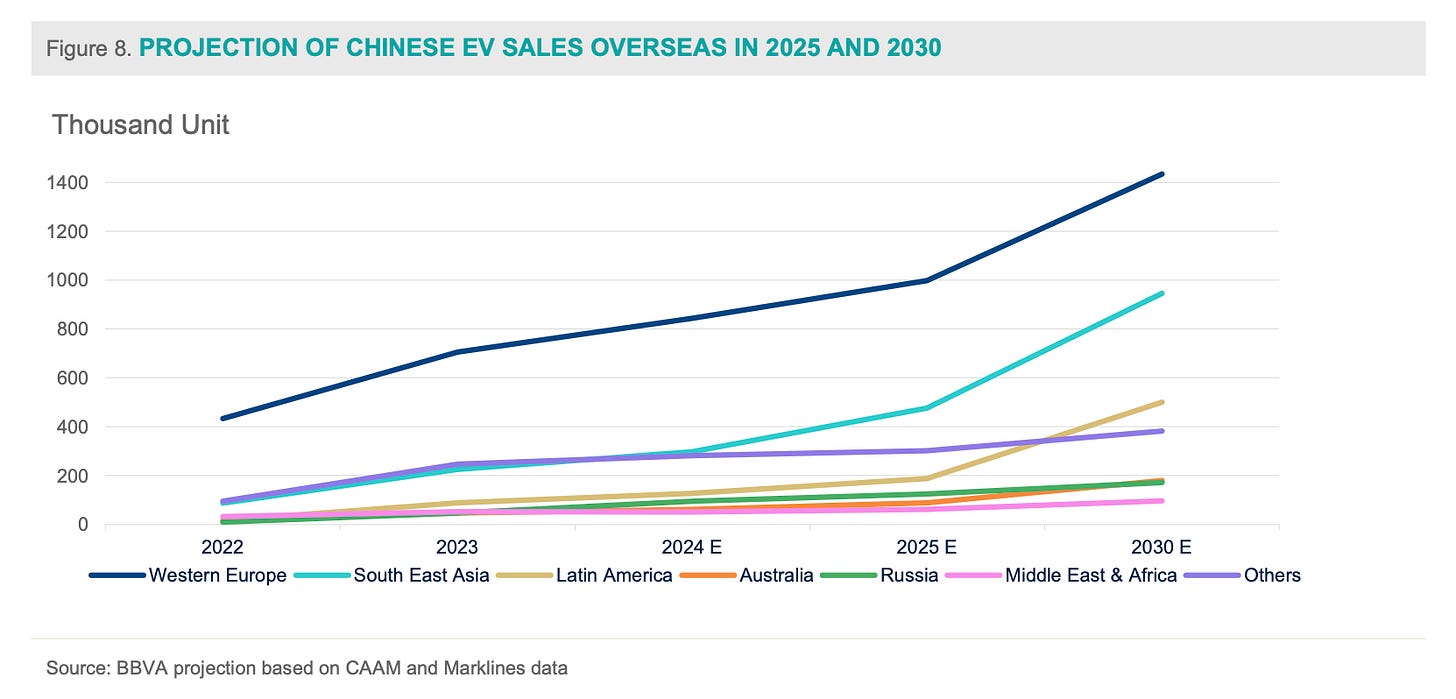

This matters even more when placed in the context of Europe’s accelerating shift toward decarbonization. With the EU phasing out internal combustion engines by 2035, maintaining openness to Chinese investment, and accounting for over 20% of global EV penetration, Western Europe has become the top global destination for China-made passenger cars. But rather than exporting solely from China — where geopolitical tensions and trade barriers are growing — Beijing is increasingly turning to regional production platforms like Egypt.

This is where the Geyushi Automotive case becomes emblematic. By supplying Egyptian firms with critical components while keeping final assembly local, Chinese companies are embedding themselves within a friendly industrial base that offers more than just manufacturing capacity. Egypt’s trade agreements with the EU and others allow Chinese EVs to reach European markets without the political scrutiny, tariffs, or regulatory pushback that direct exports from China might provoke.

The strategy serves multiple goals:

It helps Chinese firms offload domestic overcapacity through externalized production;

It lowers export risk by operating through third-party host countries;

And it allows China to hedge against rising trade friction with the U.S. and possibly the EU.

In short, Egypt isn’t just a partner — it’s a platform. It’s part of China’s broader logistical workaround and geopolitical hedge: a way to stay commercially competitive in the West while deepening economic influence across the Middle East and Africa.

Link to BBVA report on China | EV sector: forging ahead amid intensifying headwinds: https://www.bbvaresearch.com/wp-content/uploads/2024/06/202406_Chinese-EV-sector_forging-ahead-amid-intensifying-headwinds.pdf

3. China Signals Interest in Libya’s Political Endgame

In Tunis, the UN’s special envoy for Libya, Raisedon Zenenga Tetteh, met with Chinese diplomat Liu Jianchao amid renewed international efforts to revive Libya’s frozen political process.

Tetteh briefed Liu on the UN-backed consultations, including work by the advisory committee aimed at securing a consensus between rival Libyan factions. Liu, in turn, reaffirmed Beijing’s support for the UN mission and the special representative’s role in breaking the deadlock.

The meeting signals quiet but steady Chinese engagement in North Africa’s most complex conflict. While Western powers push loudly for elections and political deadlines, Beijing is playing a quieter, slower game — presenting itself as a neutral, non-interventionist partner. But that neutrality is calculated. By avoiding overt political entanglement, China sidesteps risk while quietly building credibility with whoever comes out on top. Its focus isn’t on shaping Libya’s politics today — it’s on being first in line for tomorrow’s reconstruction contracts, energy deals, and infrastructure projects.

4. China’s Crude Imports from Saudi Arabia Dip to 12-Month Low

Saudi Arabia’s oil shipments to China are expected to fall in April to their lowest level in over a year — about 35.5 million barrels, down from 41 million in March. The decline comes even as OPEC+ prepares to increase output, underscoring how China’s domestic dynamics, rather than producer policy, are now setting the pace for imports.

The dip is primarily due to scheduled maintenance at several Sinopec-run refineries, with at least 700,000 barrels per day of capacity offline through May. Affected plants include the Yangzi, Jiujiang, and Gaoqiao refineries, key nodes in China’s state-run energy system.

Meanwhile, Asian crude markets are rebalancing after recent disruptions caused by U.S. sanctions on Russian and Iranian oil. Chinese imports from both countries are expected to rebound in March, as non-sanctioned tankers enter the trade to replace embargoed vessels.

Implications:

While the current drop is technical, it aligns with China’s broader efforts to diversify supply and de-risk its energy inputs.

Rebounding flows from Iran and Russia, despite U.S. pressure, suggest that Beijing is willing to exploit gray-market opportunities when the price and leverage are right.

Saudi Arabia remains China’s top supplier — for now. But as Beijing sharpens its energy playbook around price, flexibility, and political cover, even trusted partners will face competition.

5. Mixed Signals: Chery Disputes $1B Factory Plan in Turkey

Conflicting statements between Ankara and one of China’s top automakers highlight the murky politics of industrial expansion:

Turkey’s Claim: Chery Automobile’s partners are investing $1 billion in a new factory with capacity to produce 200,000 vehicles annually.

Chery’s Denial: The company immediately issued a statement denying any plans to build a factory in Turkey.

Ankara’s Pushback: A Turkish industry ministry official reaffirmed the deal, clarifying that Chery’s “partners”are behind the investment—not Chery directly.

Chery is far from a minor player. As a major state-backed automaker and one of China’s leading vehicle exporters, it sits at the heart of Beijing’s strategy to dominate global EV supply chains. Turkey, meanwhile, sees an opening. Positioned at the intersection of Europe, Asia, and the Middle East, Ankara is actively courting Chinese capital to position itself as a manufacturing base and export gateway for China’s outbound industrial expansion.

© 2025 The China in MENA Project. All rights reserved.

Newsletter every Monday & Friday ( X: @chinainmena)

Founder/Manager Zineb Riboua ( X: @zriboua)

Contact: riboua@chinainmena.com